Global Financial Clarity for International Professionals

Build wealth, protect your legacy, and retire with confidence — wherever life takes you.

Based in Dubai — Serving Clients Globally

Over 15 Years of Cross-Border Wealth Planning

Trusted by Senior Professionals Across Aviation, Engineering & Consulting

Who I Work With

We specialize in serving high-achieving professionals who lead dynamic and demanding lives. Our clients trust us to provide tailored financial solutions that adapt to their lifestyle, profession, and long-term goals.

Tailored financial strategies for:

Airline Captains & Crew

With demanding schedules, multiple home bases, and complex international tax considerations, aviation professionals require expert financial planning. We provide solutions that account for irregular income, pension transfers, cross-border compliance, and long-term security—so you can focus on flying while we handle your financial altitude.

Engineers & Consultants

Analytical minds need data-driven strategies. Whether you're an independent consultant or part of a global firm, we help you optimize your income, plan for retirement, and protect your assets with intelligent, tax-efficient solutions. Our guidance ensures your financial foundation is as solid as the systems you design.

Globally Mobile Professionals

A proven 5-step process designed to simplify your finances, align with your goals, and provide clarity across borders. From initial discovery to long-term partnership, this framework helps you make confident decisions at every stage.

Property Investors & Business Owners

Whether you’re growing a portfolio or scaling a business, smart financial strategies are key to sustainable success. We support entrepreneurs, landlords, and high-net-worth individuals with bespoke planning for wealth preservation, risk management, succession, and expansion—helping you stay focused on growth while we protect your future.

The Horizon Framework

A Proven 5-Step Process for Long-Term Financial Clarity

A proven 5-step process designed to simplify your finances, align with your goals, and provide clarity across borders. From initial discovery to long-term partnership, this framework helps you make confident decisions at every stage.

Core Services

Expertise in the Areas That Matter Most

Retirement Planning

DIFC Wills & Legacy Structuring

Emirates Provident Fund Optimisation

Tax-Efficient Wealth Management

Global Life Insurance

University Fee Planning

Citizenship & Residency

Core Services

Expertise in the Areas That Matter Most

Retirement Planning

DIFC Wills & Legacy Structuring

Emirates Provident Fund Optimisation

Tax-Efficient Wealth Management

Global Life Insurance

University Fee Planning

Citizenship & Residency

Client Testimonials

Featured Insights

🚨 Key ruling on taxation for non-residents in Spain 🇪🇸

🚨 Key ruling on taxation for non-residents in Spain 🇪🇸 ...more

Blog

September 17, 2025•1 min read

Why Expats in Dubai Should Open a Bank Account in the Isle of Man

Why Expats in Dubai should open a Bank Account in the Isle of Man ...more

Blog

July 12, 2024•3 min read

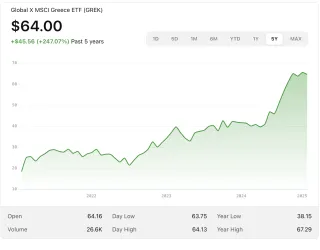

Why Gold Mining Stocks Have More Room to Run

Why Goldminers stocks have more room to run ...more

Blog

April 19, 2019•2 min read

Wherever You’re Headed, Make Sure Your

Finances Are Ready for the Journey.

Wherever You’re Headed, Make Sure Your Finances Are Ready for the Journey.